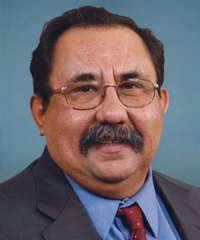

Raúl Grijalva began his career in public service as a community organizer in Tucson. Four decades later, he continues to be an advocate for those in need and a voice for the constituents of his home community. From 1974 to 1986, Raúl served on the Tucson Unified School District Governing Board, including six years as Chairman. In 1988, he was elected to the Pima County Board of Supervisors, where he served for the next 15 years, chairing the Board for two of those years. Raúl resigned his seat on the Board of Supervisors in 2002 to seek office in Arizona’s newly created Seventh Congressional District. Despite a nine-candidate primary and the challenge of being outspent three-to-one by his closest competitor, Raúl was elected with a 20-point victory, thanks to a diverse coalition of supporters that led the largest volunteer-driven election effort in Arizona.

By the numbers:

Social Security does not contribute a penny to the deficit and is legally prohibited from doing so. I will not support any attempts to privatize Social Security, which risks the retirement security of millions of Americans by subjecting them to an unpredictable stock market. Further, diverting money from trust funds into private accounts would be extremely costly and could cause benefits to be scaled back. Maintaining a strong social security program is especially critical to millions of American women, who continue to face unjustified pay gaps. Consequently, women on average, are less likely to have retirement savings and disproportionately rely on their Social Security benefits as a main source of income.

Strengthening Social Security

Since I was first elected to Congress in 2002, I have supported efforts to strengthen the solvency of the program and expand the meager benefits. In particular, I support legislation to strengthen Social Security solvency while improving benefits by fixing the outdated cost of living adjustment (COLA) formula so that benefits keep pace with actual costs seniors are facing. I support legislation to close the payroll tax loophole and ensure that every American pays their fair share into Social Security. Ninety-four percent of Americans pay Social Security tax on all of their income, yet the wealthiest six percent, who have an annual income greater than $128,400, don’t pay taxes on income above that amount. It’s not fair that the highest-income earners among us pay a lower rate than the rest of us. Closing this loophole for the wealthy will ensure that Social Security remains solvent and able to pay full benefits for at least the next 50 years.